Basics candlesticks.

It is very important that you learn how to interpret the green / red candles. The strategy described in the book is not based on all sorts of complicated indicators, but on the story behind the candles.

That is why you need to understand the basics of the candles. Below you will find an excerpt from the book explaining the candles. In the book we will elaborate on this and tell you which patterns are important.

Being able to read and understand the Candlesticks.

All candles are born "neutral".

You may be wondering, “What is this? Why is there a line there?” It is not just a line - it is a newborn baby candle! That sweet little line is a neutral candle. So now, not a single Satoshi has gone up or down.

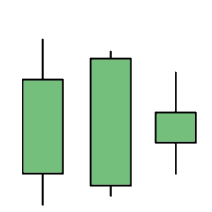

Candles are always born neutral. After birth, they grow up to become a "bearish" or a "bullish" candle, or sometimes, neither of them!

Traders do not know what a newborn candle will be. They can speculate about this, but they can never really know what it will be until the candle "dies" (closes). When the candle is born, the fight starts, the bulls and the bears fight it out while the candle shows who is winning.

When the buyers are stronger, you will see that the candle goes up and becomes a green "bullish" candle. But if the sellers are stronger, you will see that the candle goes down and becomes a red "bearish" candle.

This all sounds very logical, but think about it. Each candle indicates who is winning, the bulls or the bears.

This all sounds very logical, but think about it. Each candle indicates who is winning, the bulls or the bears.

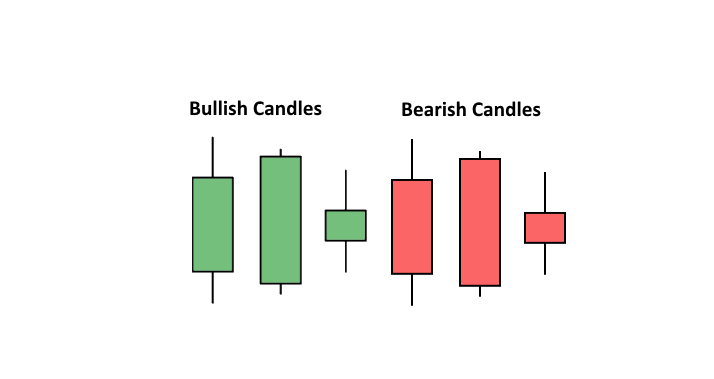

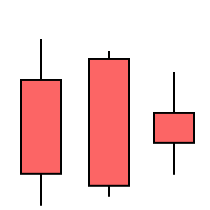

Bullish candles

Traders call a bullish candle a candle that has a green "body". The baby candle grew up and died with a bullish body.

If it has a long bullish body, you know it was a strong bullish candle.

If it has a short bullish body, you know it was a weaker bullish candle.

Simple?

This gives you a lot of information. The candle not only tells you what the price is - but it also tells you that the bulls have won and with what power they have won.

These bullish candles tell us that there are more buyers than sellers and tell us about the power of the candle compared to the other candles.

This is crucial information in the entire trading market.

If a strategy or system tells you to sell, but the candle is still green, this is probably not a good idea. Why sell if there are more buyers in the market? Reading candlestick patterns allows you to understand better what the price is in a certain situation and why it is.

Bearish candles

A bearish candle is a candle with a bearish body. What can you make out of a bearish candle? It tells you that there are more sellers in the market than buyers.

It tells you that the sellers are in control and what their strength is. So buying here might not be a good idea.

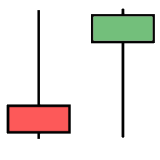

Wicks

In addition to showing what the candles' highest and lowest point was during the life of the candle, a wick will also flood you with other information.

Remember the fight between the bulls and the bears? Time to learn what this means in combination with the wicks.

When a strong bullish candle suggests that the bulls are in control of the market, what does a bearish candle with a long upper wick say?

Small lower wick, small bearish body, and a long upper wick: This candle tells us that somewhere in the life of this candle, the bulls have tried to raise the price. That is what the long upper wick tells us. However, even before the candle died, the bears took over again and drove the price down. You can see this by the red bearish body.

Long lower wick, small bullish body, and a small upper wick: This candle tells us that somewhere in the life of this candle, the bears have tried to push the price down. That's what the longer bottom wick tells us. However, even before the candle died, the bulls took over again and pushed up the price. You can see this by the bullish green body.